CKB Tokenomics - A Different Model

The Nervos Network, a structured public blockchain biome, is aimed squarely at solving the key problems with the Bitcoin and Ethereum blockchains

One very interesting thing about the innovative ecosystem we live in is; when you think it can't get any better, there is a person or group of persons waiting to jump at you with a "you're wrong!" placard. This is the current situation in the blockchain community.

Different innovations have surfaced in an attempt to solve the major problems that plague the blockchain community. But each one presents itself with an oversight. The question is whether we will ever be able to create a flawless functional system that ensures blockchain’s long-term viability.

A group of developers seem to hold the answer to that question, as their innovation and proposed structure could proffer the best remedy within the blockchain community.

A Work In Progress - The Nervos Network Common Knowledge Base (CKB)

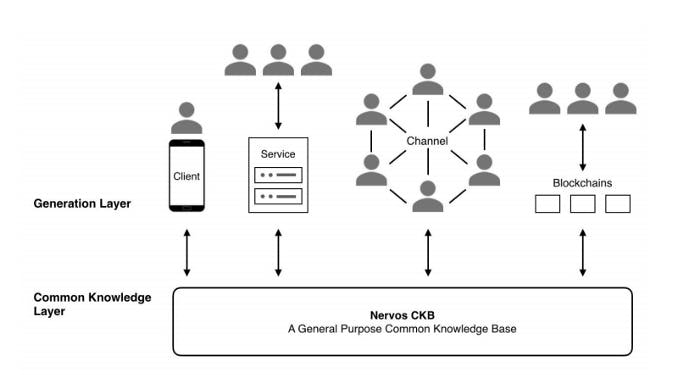

The Nervous Network, a carefully structured public blockchain biome, is aimed squarely at solving the key problems with the Bitcoin and Ethereum blockchains. It features a two-layered architecture that allows for cross-chain interoperability, increased functionality, and scalability.

The Nervous CKB is the base layer with Proof of Work (PoW) consensus that integrates the decentralized and secure nature of Bitcoin to facilitate storage for crypto assets while enabling smart contracts. The unique tokenomic design of the Nervos Network’s layer 2 structure, which focuses on its token as a Store of Assets, creates value for the Nervos Network.

Understanding The Tokenomics Of CKB

According to its creators, by structural design, the CKB functions with two layers; an on-chain state base and off-chain transaction, and by economic design. It is structured to enable decentralization and long-term sustainability.

The CKByte is the native token of the Nervos network. It functions in two offices. First, as a store for data on the on-chain layer, and second, to enable computations on the off-chain layer.

Just like "Satoshis" is the smallest indivisible unit of Bitcoin, CK Shannon is the same for CKBytes. Where 1 CKByte is equivalent to 10^7 CK Shannons.

The Nervos CKB uses two issuance types for its token. The base issuance mirrors Bitcoin; in the sense of supply limit, and a halving event that happens every four years till the supply runs out. This issuance serves as an incentive for miners to maintain and grow the network.

There's also a secondary issuance with a limited yearly supply, which will continue to exist after the initial issuance runs out. It is set up to accumulate state rent.

State Storage - Putting A Cap

A major concern with Bitcoin and Ethereum is the problem of unlimited state storage on the various blockchains. The absence of a cap on the accumulation of current state poses a threat to both parties’ storage capacity being exhausted or overburdened.

The Nervos network anticipated such challenges and created a unique structure to curb it. The double issuance adopted creates a boundary to the state storage. This boundary creates scarcity for the state capacity, making it more valuable. The CKB collects state rent using two steps, one of which employs the Nervos DAO.

A Hedge Against Inflation

A special smart contract designed into the Nervous network, the Nervos DAO, creates a covering from inflation caused by the secondary issuance. Long-term players having dormant tokens can protect their CKBytes in the Nervos DAO against future inflation.

The Miner's Compensation

Properly compensating miners for their role on the network is a top priority. Therefore, two sources of income are made available; rewards for mining blocks and fees from validating transactions - with room for more incentives in the future.

A Different Tokenomics Approach

The Nervos network tokenomics approach focuses directly on asset preservation. As indicated by its creators, the core of this approach hinges on three crucial factors; protocol security, sustainability, and user-network interests alignment.

A Security And Sustainability Fix

To integrate network security and overall network sustainability, the Nervous network created this design:

There is a direct link between the value of assets held and the tokens used. This link makes an increase in requests for storage space be directly proportional to an increase in token requests. Because, without the tokens, storage space cannot be allocated.

Miners' compensation are protected and determinable based on its preservation, not transactional requests. This is achieved with the secondary issuance. When the base issuance gets exhausted, the mining community is still well compensated.

Synchronizing Users Objectives With Network Objectives

In an ecosystem where every player is satisfied, the overall wellbeing of the network is certain. The Nervos tokenomic model was structured such that it aligns every player's aim. Interests like lower fees for users, application adoption for developers, constant profitability for miners, and an increase in token value for holders — all meet at the same point.

The model believes an increased token price favors everyone, because it'll increase adoption, lower the fees for users, increase the ecosystem's security, increase miners’ profitability, and increase ROI for holders.

Implementation Areas For CKB Tokenomics

The tokenomics of the Nervos network function as foundational blocks upon which software or application developers that choose the network can build their personal Crypto-economics model. An example of two foundational blocks are; liquidity and subscriptions.

A Mini Insurance Policy (Liquidity)

The Nervos CKB makes providing liquidity easier. If users were to borrow in the lending market, the CKB network makes it possible for transaction operators on layer 2 to request for a specific token deposit as leverage before providing liquidity to the market and profiting from it. This is another source of income for operators on the network

Payment On Completion (Subscriptions)

For service providers on the network that require a certain duration to fulfill requests, they can request that users put away a fixed number of native tokens in the Nervos DAO and make them beneficiaries of the account, which is to be released on completion of the contract.

This development by the Nervos Network could put an end to major problems within the blockchain community. But it is worthy to note they are still in the development stage, and it’s all still a promise.